WhatsApp launches payment feature in SG

Users will be able to send payments to merchants.

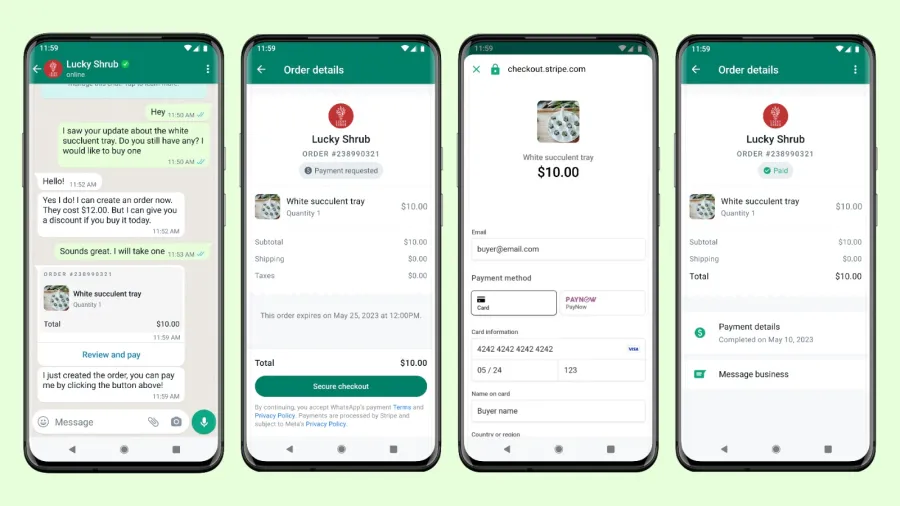

Singapore-based businesses can now pay and receive payments directly on their WhatsApp chat.

The new venture is offering a seamless and secure experience without the need to visit a website, use a separate app, or pay in person. While it is currently being rolled out to a small number of businesses, it will become available to many more in the coming months.

ALSO READ: What’s Singaporean’s go-to app for personal and business use

In collaboration with payments service provider partner, Stripe, the new feature will enable Singapore residents (with a registered WhatsApp number) to pay using credit cards, debit cards or PayNow.

Local businesses in Singapore using the WhatsApp Business Platform can enable the payments feature. For other interested businesses, they can work with business solution providers (including launch partners Vonage, Gupshup, 360dialog, and Wati.io) to get started with offering this feature to their customers.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise