Chart of the Week: Over 1 in 4 of Taiwan’s online transactions use alternative payments

Over a quarter of Taiwanese online shoppers prefer to pay via alternative payment methods.

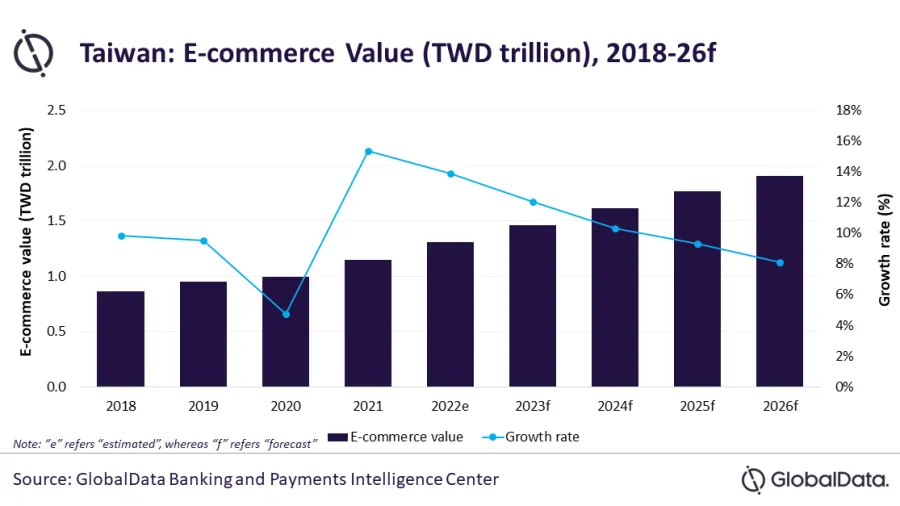

Taiwan’s e-commerce market grew by 13.9% to TWD1.3t ($42.6b) in 2022, according to findings from GlobalData’s 2022 Financial Services Consumer Survey.

About nine out of 10 Taiwanese people said they have made online purchases in the past six months, whilst the remaining stated they never shopped online.

In terms of payment options, the survey found that 47.1% of those who shop online still prefer payment cards.

“This can be attributed to reward programs including interest-free instalment options, cashback, discounts, and other benefits. Alternative payment solutions are also popular in Taiwan, with Line Pay, 7-11 Ibon, and Apple Pay being the major brands,” the report said.

ALSO READ: Card payments in South Korea to breach $1t: GlobalData

However, the share of cash users continuously declined in 2022 with nearly 9% of the total online shoppers surveyed.

“Taiwan will continue to witness high growth in e-commerce sales, which is forecast to grow at a compound annual growth rate (CAGR) of 9.9% between 2022 and 2026 to reach TWD1.9 trillion ($62.2 billion) in 2026,” GlobalData, senior banking and payments analyst, Kartik Challa said.

Challa expects the usage of alternative payment methods to continue its growth but still has a long way to go to outweigh card payments.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise