Payment cards account for 60.9% of e-commerce purchases in South Korea

Added-value benefits of using cards help maintain its dominance.

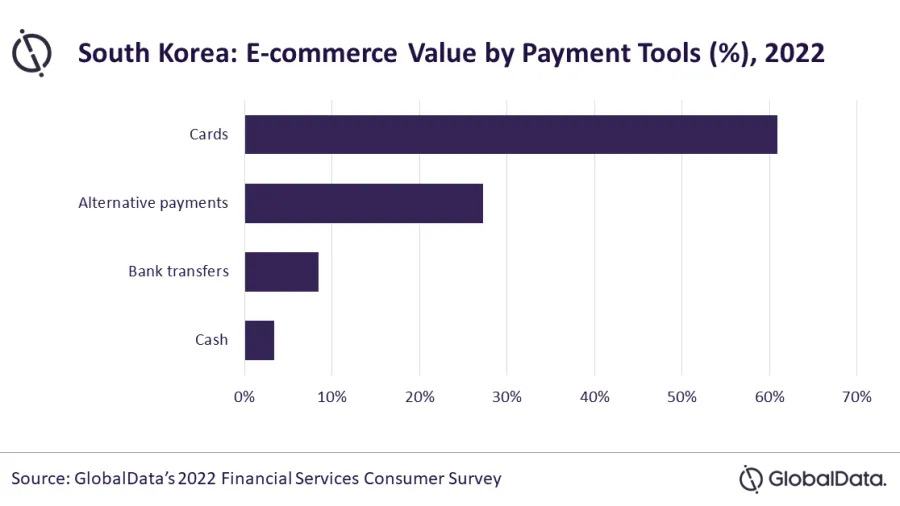

Payment cards made up 60.9% of all payments for online purchases in South Korea in 2022, according to a survey released by data and analytics company GlobalData.

Payment cards are followed by alternative payment tools which collectively accounted for a 27.3% share in 2022 – up from 15% in 2020. Alternative payment solutions such as Naver Pay, Samsung Pay, Kakao Pay and SmilePay are popular amongst online shoppers, the study found.

“Alternative payments are increasingly being embraced by Korean consumers for online shopping, a trend that is prevalent in many Asian markets. However, they still have a long way to go to challenge the dominance of payment cards,” said Ravi Sharma, lead banking and payments analyst at GlobalData.

ALSO READ: Banks in South Korea to maintain eased stance in extending loans

E-commerce payments in South Korea have traditionally been dominated by payment cards. Credit and charge cards alone account for a 53.2% share in e-commerce payment value in 2022. This is due to the value-added benefits, including interest free instalment payment options, reward programs, cashback, and discounts associated with these cards, Sharma noted.

Bank transfers were also another ways of paying used by South Koreans for their online purchases. However, its share has declined from 12.7% in 2021 to 8.4% in 2022 due to growing preference for cards and alternative payment tools, according to GlobalData.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise