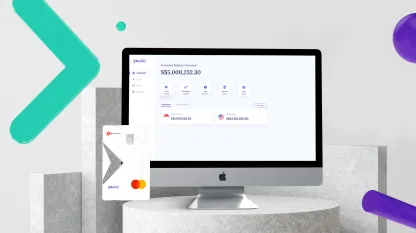

Payments platform YouTrip unveils YouBiz offering zero FX fees and unli cashback

YouBiz is also launching a credit facility offering flexible financing to SMEs.

Singapore’s YouTrip has launched YouBiz, a corporate card aimed at small and medium enterprises (SMEs) offering zero foreign exchange fees and 1% cashback on all card spending.

Powered by Mastercard, YouBiz allows SMEs to receive, hold and spend in nine currencies currently–Singapore Dollar, US Dollar, Euro, British Pound, Australian Dollar, Hong Kong Dollar, Japanese Yen, Swiss Franc, and Thai Baht—and make an immediate exchange at competitive rates and no fees.

YouBiz enables SMEs to generate physical and unlimited virtual cards for payments at more than 80 million Mastercard merchants worldwide, in over 150 currencies, online and in-store.

Alongside its launch, YouBiz is also introducing a credit facility that offers flexible business financing to SMEs. Businesses to obtain unsecured and collateral-free term loans with no hidden or early repayment fees. Loans will be disbursed to the YouBiz account within 48 hours.

Parent company YouTrip recently secured US$30m in Series A funding.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise