China’s card payments market to hit $34t by 2025

The market is expected to register a strong growth of 17% in 2022.

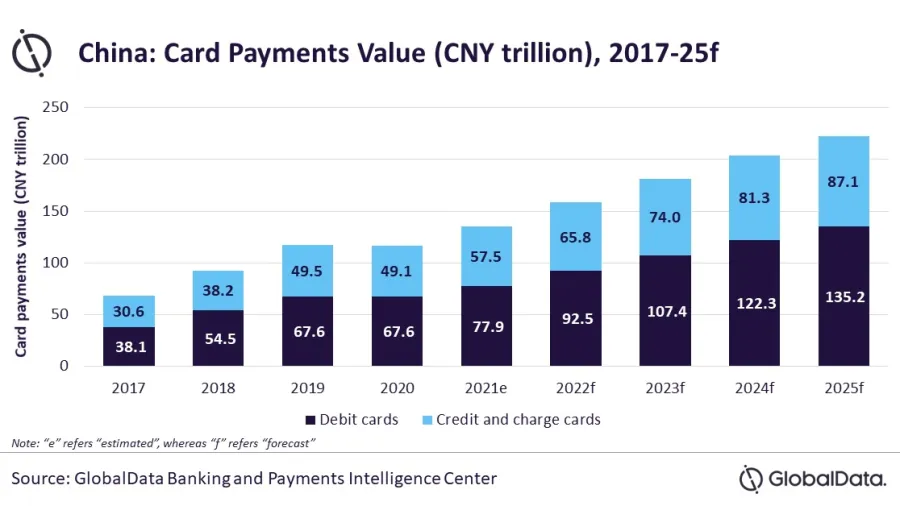

The value of China’s card payments market is expected to grow at a compound annual growth rate (CAGR) of 13.2% between 2021 and 2025 and reach $34t (CNY222.3t) by the end of the period, according to estimates by data and analytics company GlobalData.

In 2022 alone, the card payments market in China is expected to register a strong growth of 17%.

With the COVID-19 restrictions now eased and consumer spending on the rise, both debit and credit card use is expected to increase, GlobalData said.

Major sporting events, such as the Beijing 2022 Winter Olympics and Paralympics, will also push spending.

China’s debit card payments are posited to grow by a CAGR 14.8% between 2021 and 2025.

Meanwhile, credit and charge cards will also rise, with GlobalData expecting a CAGR of 10.9% over the same period.

You may also like:

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise