Chart of the Week: Singapore card payments value to grow 8% in 2022

Contactless cards are a key driver of growth.

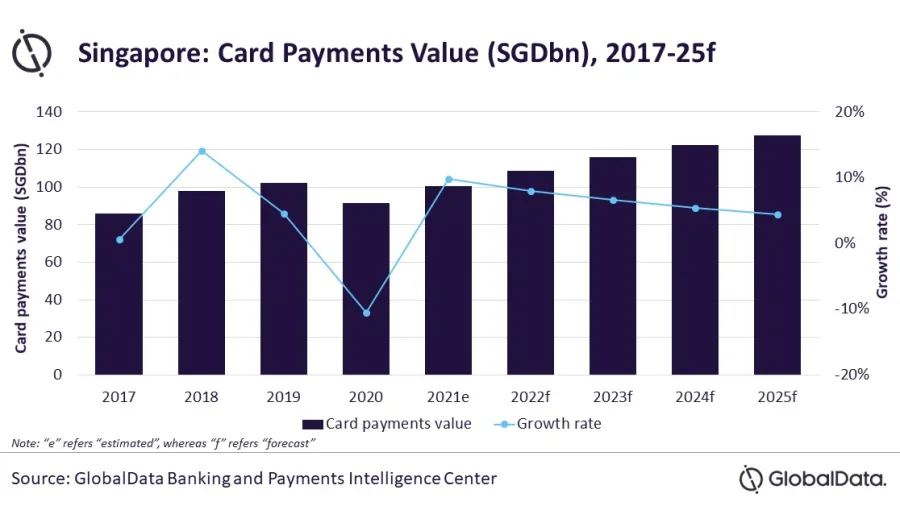

The value of card payments in Singapore is set to grow 8% in 2022 amidst improving economic conditions, forecasts data and analytics company GlobalData.

The country’s card payments market rebounded 9.9% in 2021 to reach $76.1b (S$100.6b) by the end of the year. This follows after a 10.5% decline in 2020.

GlobalData estimates the value to further grow at a compound annual growth rate (CAGR) of 6.1% between 2021-2025 and be worth $96.6b (S$127.6b) by 2025.

Growth in card payments is supported by its large card acceptance network, with almost six-point of sale (POS) terminals for every 100 individuals in 2021. This is much higher compared to its peers including Australia (3.7), New Zealand (3.6), China (2.8), Hong Kong (2.5), Japan (1.9), and Taiwan (0.5).

In particular, Contactless card payments were noted as a key growth driver, with consumers increasingly favoring contactless cards for low-value transactions instead of cash.

“Singapore has a developed payment card market with high degree of usage and penetration. Whilst the COVID-19 pandemic and the uncertainty associated with it impacted card payments, the resumption of business activities and revival in consumer spending helped card payments recovery,” commented Nikhil Reddy, senior analyst at GlobalData.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise