Chart of the Week: Vietnam’s card payments market to grow 24.1% in 2022

Strong anti-COVID measures allowed the market to reduce the pandemic’s impact.

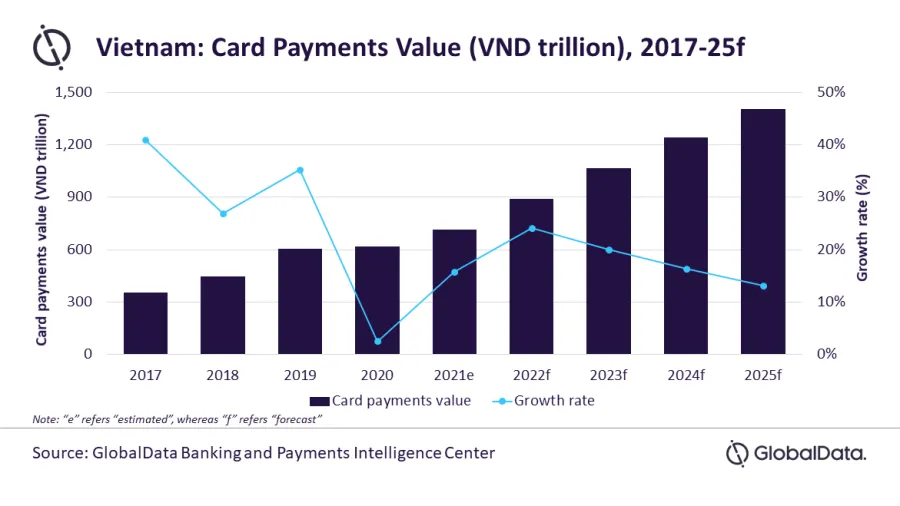

Vietnam’s card payments market is forecast to grow 24.1% in 2022 as its economy recovers, according to GlobalData.

Thanks to the country largely controlling the spread of COVID-19, supported by a well-developed public health system and comprehensive contact tracing measures, the pandemic had a reduced impact on Vietnam’s economy. This is reflected in the 2.9% and 2.5% gross domestic product growth it registered in 2020 and 2021, respectively.

Its card payments market followed this resiliency, growing by 2.4% in 2020. In contrast, Asian peers, such as Indonesia and Malaysia, witnessed a decline.

The market is expected to ramp up its growth over the next few years and reach $60b (VND1,404.7t), growing at a compound annual growth rate (CAGR) of 18.3% between 2021 to 2025.

“The Vietnamese payment card market is expected to register strong growth in the next five years supported by government initiatives to increase banked population and adoption of electronic payments,” comments Nikhil Reddy, payments senior analyst at GlobalData.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise