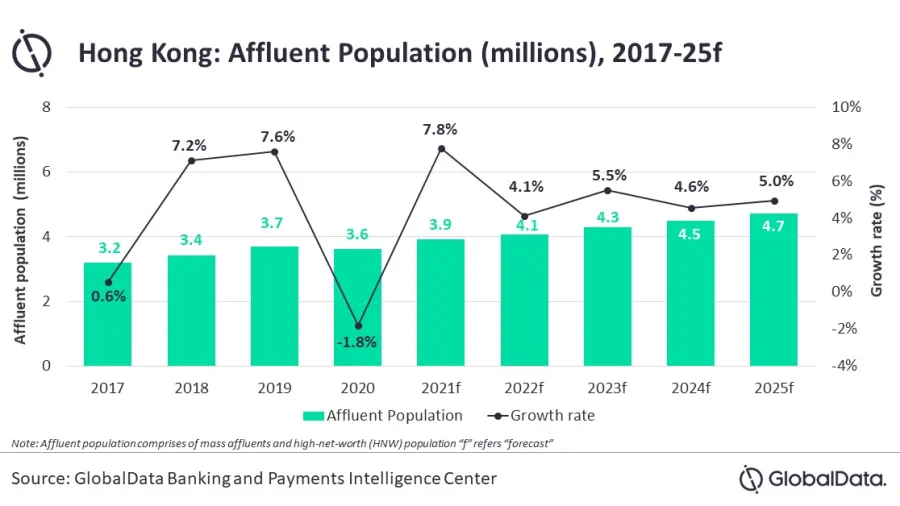

Chart of the Week: Hong Kong’s wealth market to grow 7.8% in 2021

The number of HNWIs is expected to reach 3.9 million in 2021 or 60.6% of the population.

Whilst China may still hold the biggest slice of the wealth pie, banks should not disregard Hong Kong’s wealth market, which is expected to rebound in 2021 after a pandemic-induced contraction in 2020, reports data and analytics company, GlobalData.

The number of high-net-worth individuals (HNWI), or those holding liquid assets of more than US$1m, is expected to grow by 7.8% to reach 3.9 million in 2021, the study said.

GlobalData’s Wealth Market Analytics further notes that Hong Kong’s affluent population—which include the mass affluent or those holding US$50,000 to US$1m in liquid assets, alongside HNWs—collectively account for 60.6% of its total population in 2021. This is significantly higher than in Singapore (32.2%), China (5.3%), and India (0.7%).

“The population of affluent investors is expected to rise in coming years supported by the recovery in the economy, widespread vaccinations and improvement in stock market performance,” Ravi Sharma, lead banking and payments analyst of GlobalData. “Furthermore, an expected increase in residential property prices will result in capital gains, which will further boost investors’ optimism.”

The Hong Kong wealth market is set for recovery as its economic performance is expected to regain momentum and this results in a shift away from deposits among the investors, towards riskier asset equities and mutual funds, both expected to see strong growth, GlobalData also reported.

The number of affluent individuals in the city recorded an average annual growth rate (AAGR) of 5.1% between 2017 and 2019, rising from 3.2 million in 2017 to 3.7 million in 2019 on the back of strong financial market performance.

But, the economic turmoil caused by the COVID-19 pandemic rained down on this parade, negatively affecting the local real estate and stock market, and subsequently impacted Hong Kong’s affluent population, which are notably more exposed to both sectors.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise