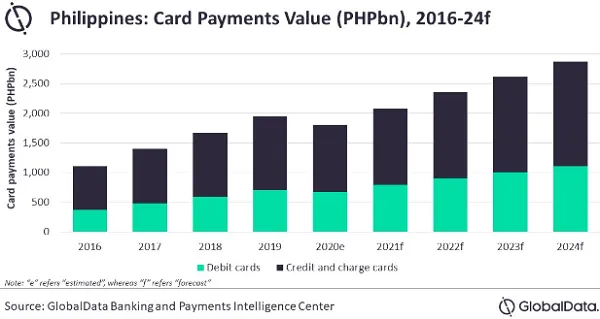

Chart of the Week: Philippine card payments market value to grow to $43.4b in 2021

Debit cards dominate in the Philippines with 90.6 million in circulation.

This chart from GlobalData shows that a gradual economic recovery, easing of lockdown, and rising consumer spending will push the Philippines’ card payments market to grow 15.4% in 2021. The value of card payments in the country will reach $43.4b (PHP2.1t) and is expected to register a compound annual growth rate of 12.3% between 2020 to 2024 to hit $59.8b (PHP2.87t) in 2024.

“The market scenario is now changing with the opening of businesses and vaccine distribution gaining pace. Gradual revival in economic conditions are expected to drive growth in the country’s card market,” said GlobalData Analyst Nikhil Reddy.

Debit cards dominate the overall card holding in the Philippines with 90.6 million debit cards in circulation versus 8.6 million for credit and charge cards. However, credit and charge cards are the preferred payments method, accounting for nearly two-thirds of card payments by value.

This is mainly due to pricing benefits, instalment payment plans, and reward programs available on these cards, the report said. Whilst the credit and charge market was adversely affected by the pandemic, it is expected to rebound with higher consumer spending.

The Philippine government has also taken various initiatives to push for card usage in the country. In September 2020, it passed a regulation capping credit card interest at 2% per month, effective 3 November the same year. It also capped the interest on credit card instalment plans at 1% per month.

Amidst the pandemic, demand for contactless payments has surged significantly which will support growth in card transactions, GlobalData said. All major banks in the country now offer contactless credit cards, with Mastercard increasing the limit for contactless payments to $98.60 (PHP5,000) effective 17 July 2020.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise