Chart of the Week: South Korean card payments to grow 4.9% through 2024

Average frequency of use is 136.2 times in 2020, higher than in France, US, and UK.

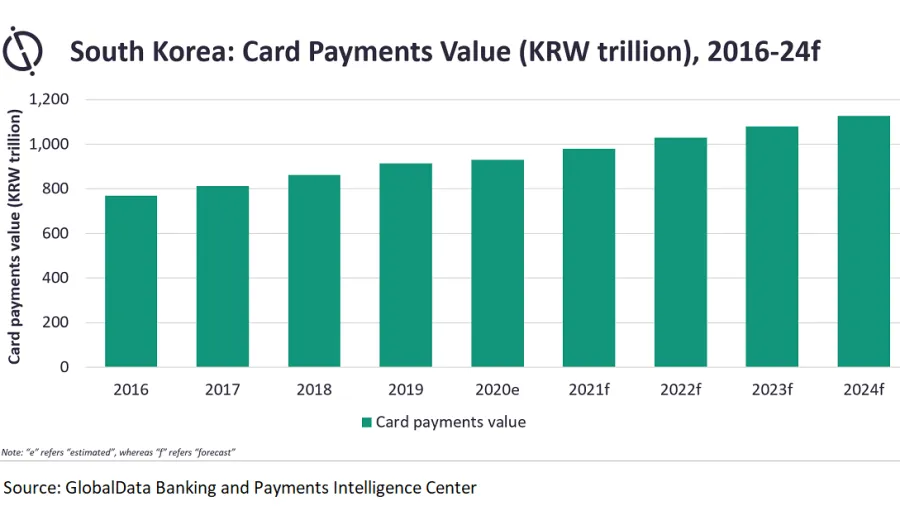

South Korea’s card payments market is forecasted to grow at a compound annual growth rate of 4.9% between 2020 and 2024, to reach $1t (KRW1,127.8t) in the next three years, according to a report by data and analytics company GlobalData.

The country’s card payments market is expected to rebound with a 5.3% growth in 2021, supported by the country’s well-developed payments market, said Sowmya Kulkarni, senior banking and payments analyst, GlobalData.

“The country’s payment cards market is well developed and has been on a sustained growth for the past few years. High banked population, developed payment infrastructure and high financial awareness, has resulted in high card penetration and usage,” Kulkarni said.

“The COVID-19 outbreak hampered the growth of card payments in South Korea. [However], it is expected to rebound in 2021 and grow strongly over the next four years, supported by its well-developed payment infrastructure, high card acceptance rate among merchants and rising preference for digital services,” Kulkarni added.

On average, South Koreans hold five cards per person, according to Kulkarni. Average frequency of credit card use is also much higher than in developed markets such as France, Canada, UK, and even the US, at 136.2 times in 2020.

Credit card is the preferred payment card in the country due to pricing benefits it offers. However, credit card use is being challenged with the rise of debit cards. Usage of the latter is gradually increasing, from 20.2% in 2016 to 21.4% in 2021.

Growth in debit card usage has been supported by government tax benefits, with debit card holders getting a tax deduction of 30% on their expenditure – double the equivalent for credit cards. This has been further increased to 60% in June 2020 as a relief measure due to COVID-19.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise