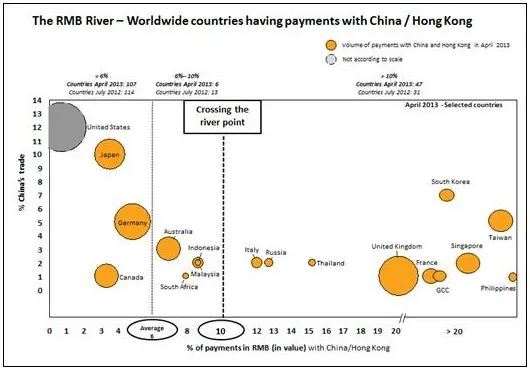

More countries use RMB for more than 10% of their payments with China and Hong Kong

There are now 47 countries worldwide.

Of the 160 countries that exchanged payments with China and Hong Kong in April 2013, 47 of them had at least 10% of their payments value in Renminbi (RMB).

According to SWIFT, there has been a 9% increase in the number of countries crossing the RMB river for their payments with China and Hong Kong, since July 2012.

Here's more from SWIFT:

During the last nine months (July 2012 – April 2013), 16 more countries are now using the RMB for more than 10% of their payments with China and Hong Kong. The growth has brought the total to 47 countries worldwide.

The average CNY payment weight in all of the 160 countries jumped to 6%, giving the currency a 2% increase since July 2012. SWIFT’s RMB Tracker also shows that Italy and Russia are now amongst some of the strongest adopters of the RMB, much like the United Kingdom, Singapore and Taiwan.

Lisa O’Connor, RMB Director at SWIFT says: “The big increase in countries with substantial RMB volumes is a good indicator that the currency has become more internationalised. This also presents business opportunities for those banks with RMB business intelligence and product capabilities in those countries”.

Compared to March 2013, the RMB remains stable in its position as #13 payment currency of the world, with a decreased market share of 0.69% from 0.74%. Overall, RMB payments decreased in value by 1.8%, with the growth for all currencies relatively low at 4.9%.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise