A closer look at AEJ banks' NIMs from 2009-2011

Singapore banks had the biggest margin decline.

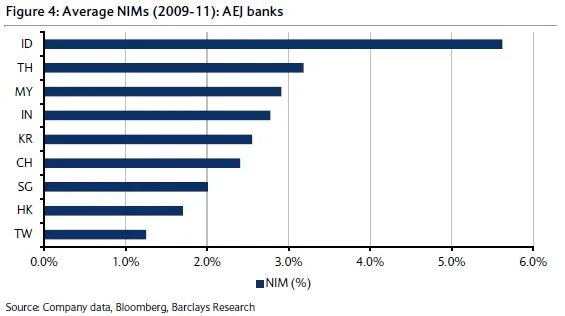

Barclays analysed NIMs across AEJ banks to understand the trends and their standing against global counterparts. AEJ banks were represented by China, Hong Kong, India, Indonesia, Korea, Malaysia, Singapore, Taiwan, and Thailand.

Here's more from Barclays:

During 2009-11, AEJ banks’ NIM was broadly range-bound with a reading of 2.71% to 2.73%, posting a 2bps marginal increase: 2bps fall in 2010, compensated by 4bps gain in 2011.

Korean banks witnessed the maximum margin expansion during the period, up 51bps, followed by China banks (up 33bps) and Indian banks (up28bps). The rest of countries witnessed margin declines led by Singapore banks (35bps), Indonesian banks (23bps) and Hong Kong banks (18bps)

During 2009-11, Indonesian banks lead the charts with a reading of 5.6% followed by Thai banks (3.2%) and Malaysian banks (2.9%).

During 2011, Indonesian banks yielded the highest NIMs with a reading of 5.6%, almost 2.5 - 2.6% above the next in the tally, Thai banks (3.1%) and Indian banks (3.0%). Amongst nine AEJ countries under our analysis, six posted NIMs above the 2.0% mark as Singapore, Hong Kong and Taiwan banks yielded 1.8%, 1.6% and 1.3%, respectively.

Click the graph to enlarge.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise