China and Hong Kong renew currency swap agreement

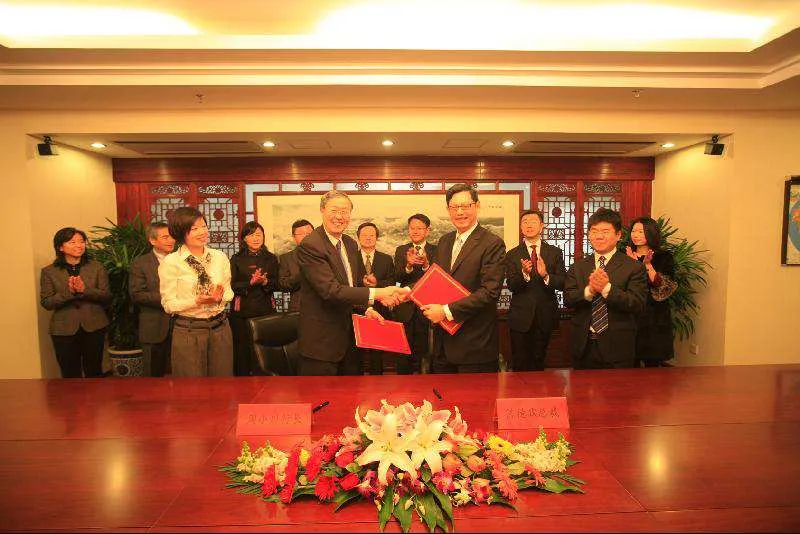

The People's Bank of China and the Hong Kong Monetary Authority have signed a renewed currency swap agreement for a term of another three years.

The size was also expanded to RMB400 billion / HK$490 billion.

This new agreement superseded the RMB200 billion / HK$227 billion currency swap agreement signed on January 20, 2009.

Hong Kong Financial Secretary, Mr John C Tsang, said, "The renewal of the currency swap agreement and the expansion of its size will allow more flexibility for the development of Renminbi business in Hong Kong. It is also conducive to the strengthening of Hong Kong's status as an offshore Renminbi business centre."

When signing the currency swap agreement, the Chief Executive of the HKMA, Mr Norman Chan, said, "With the strong support from the Central Government and the Mainland authorities, the development of Renminbi business in Hong Kong has made very encouraging progress over the past year. The renewal and expansion of the currency swap agreement between the HKMA and the PBoC is crucial in helping us to provide liquidity, when necessary, to maintain the stability of the offshore Renminbi market in Hong Kong."

The new agreement, with an increased size, will facilitate the further development of offshore Renminbi business in Hong Kong. During the first three quarters of this year, Renminbi deposits in Hong Kong nearly doubled to RMB622 billion, while Renminbi trade settlement conducted through banks in Hong Kong amounted to over RMB1,300 billion. In October 2010, the HKMA activated the swap for RMB20 billion to support Renminbi trade settlement in Hong Kong thereby facilitating steady development of the business.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise