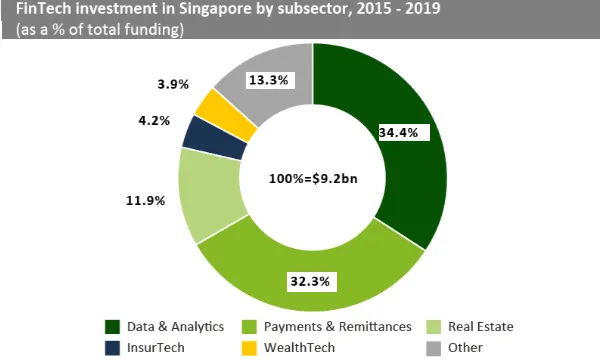

Chart of the Week: Data & analytics firms clinched 34.4% of Singapore's fintech deals since 2015

Local fintech companies raised more than $9.2b across 389 deals during this period.

Data and analytics companies captured over a third of 34.4% of Singapore’s total fintech investments since 2015, according to a report by Fintech Global.

Singapore fintech companies raised more than $9.2b across 389 transactions during the same period.

The data & analytics subsector has thrived due to the country’s access to a global talent pool, strong infrastructure, Smart Nation push (supports innovation and ambitious tech projects), and their tech-savvy government, the report noted.

The largest transaction in the country during the period was raised by Sea, a Singapore internet platform company who owns the e-commerce platform Shopee. The company raised $1.4b in a post-IPO equity round led by Tencent Holdings in March 2019.

The Other category contains companies operating in Marketplace Lending, Blockchain & Cryptocurrencies, RegTech, Institutional Investment & Trading, Infrastructure & Enterprise Software, and Funding Platforms subsectors, which collectively raised 13.3% of fintech investment in the country.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise