Asian banks stuck in an unprofitable bind

Market profitability and credit demand are likely to be affected.

Headwinds brought about by the COVID-19 pandemic will hit Asian banks across multiple channels, a Fitch Ratings report revealed.

Interest rate cuts will aggravate market profitability challenges, whilst abysmal economic growth forecasts will lessen credit demand and bring about higher credit loss provisions, especially for lenders who report under IFRS 9, said analysts Jonathan Cornish and Duncan Innes-Ker.

Capital market volatility could also prevent issuance and listing activity, thus affecting revenue streams and resulting in losses on securities portfolio holdings.

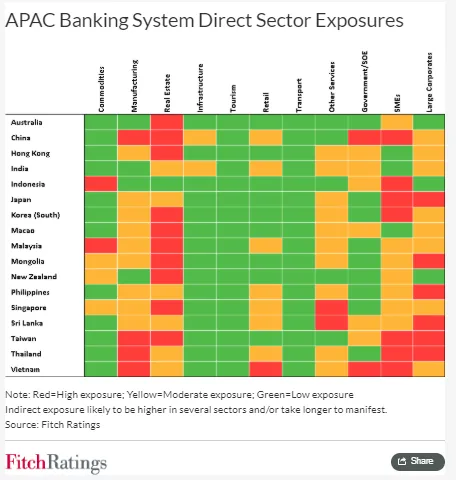

Market restrictions to curb the spread of the disease will lead to deterioration in the bank asset quality, they noted. This will initially reflect on domestic markets where banks are highly exposed to affected sectors and indirectly through trade channels and unemployment.

“The degree to which individual banks are affected will depend partly on their geographic and sectoral exposures. Further risks for APAC banks will stem from the pandemic’s effects on international funding and liquidity, affecting banks that rely on international financing from wholesale markets,” the report added.

In addition, banks in some markets have already increased their risk appetite to counteract pressure on earnings and the likelihood of decay in asset quality might not reflect until environments are less warm.

The dampened economic forecast in Asia and key OECD markets will test the quality of asset exposures outside of the lenders’ home markets, analysts said. It could also spur reevaluation of strategies that include expanding into higher growth markets with feeble operating environments.

The weakened economic outlook in Asia and in key OECD markets will test the quality of asset exposures outside of banks’ home markets. It could also prompt reassessment of management strategies that involve expanding into higher growth markets with weaker operating environments, or in markets where banks’ competitive positions are weaker than in their domestic market.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise