Chart of the Week: Hong Kong card payments to hit $7.67b by 2023

The number of card payments is expected to hit 1 billion in 2020.

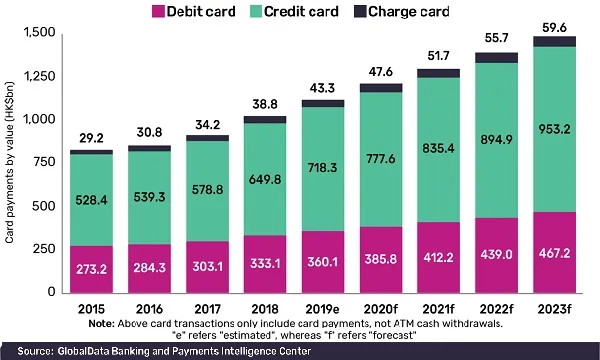

Card payment value in the market is forecasted to increase from $5.57b (HK$43.3b) in 2019 to $7.67b (HK$59.6b) 2023, according to data from GlobalData’s Payment Cards Analytics.

Meanwhile, the total number of card payments in Hong Kong is expected to make steady progress and hit 1 billion in 2020 from only 642 million in 2015.

The convenience of electronic payments, robust payment infrastructure and the emergence of contactless payments are expected to drive the volume up. Credit and charge cards already accounts for 67.9% of total card payment value in 2019

Hong Kong has a highly penetrated payment card market, with each individual holding more than three cards in 2019, the report noted. This is supported by the government and banks’ efforts to provide banking services even in remote areas, and expand banking infrastructure through the introduction of mobile banking branches, new physical bank branches and establishment of virtual banks, it added.

“The pricing benefits such as referral programs, instalment facilities, cashback and discounts associated with credit and charge cards are some of the key reasons for their preference. In addition, these cards are increasingly preferred for online shopping and for transactions overseas,” said Nikhil Reddy, banking and payments analyst at GlobalData.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise