Indian card payments surge amidst cashless efforts

Total number of card payments quadrupled from 2 billion in 2015 to 7.8 billion in 2019.

Card payments are growing in India following government initiatives as well as growing confidence in digital payments, according to a GlobalData report.

Total number of card payments quadrupled from 2 billion in 2015 to 7.8 billion in 2019 after the Indian government introduced a program offering low-cost banking services and lowered merchant fees.

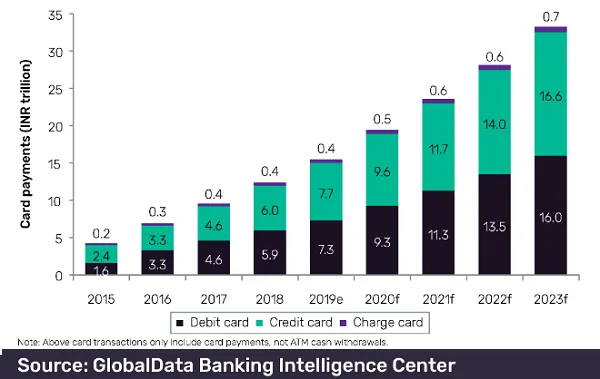

Indians prefer credit cards due to rewards, discounts, installment facilities and loans, said senior payments analyst Ravi Sharma. Value of credit card payments is expected to balloon from $110.6b (INR7.7t) in 2019 to $237.9b (INR16.6t) in 2023.

Debit card payments are also growing amidst a rising banking population and merchant acceptance, Sharma added. In January 2018, merchant discount rate for debit card transactions below $28.7 (INR2,000) was capped at 0.4% with annual turnover of less than $28,733 (INR2m). The payment value of such cards is seen to increase from $105.1b (INR7.3t) to $229.3b (INR16t) in 2023.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise