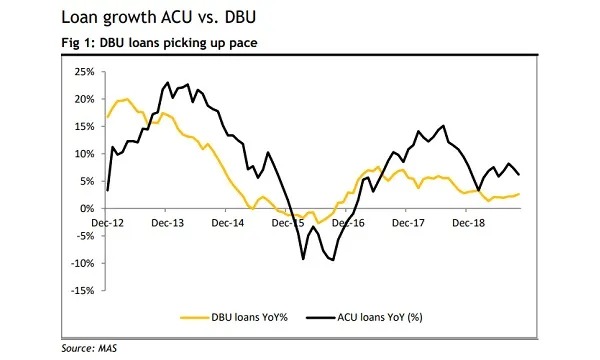

Chart of the Week: Singapore domestic loans up 2.6% in October

This is its fastest expansion since February 2019.

October saw Singapore banks’ domestic loans (DBU) rise 2.6% YoY, their fastest pace since February and suggesting a pick-up in economic activity, according to a report by Maybank Kim Eng. Overseas loans (ACU) remained resilient to a 6.2% YoY growth in October from the 7.3% YoY increase posted in the previous month.

Overall loan momentum softened to a 4.4% YoY expansion in October from the 5.1% YoY rise in August, data from the Monetary Authority of Singapore revealed. Despite the slower climb, loan growth remains at a respectable pace given the backdrop of slowing macroeconomic conditions, noted Maybank Kim Eng analyst Thilan Wickramasinghe.

Domestic business loans rose by 5.2% YoY, their strongest since February. This was driven by a 3.2% YoY expansion from the general commerce sector, reversing its trend of contractions since a year ago.

“This may signal a pick-up in SME activity, in our view,” commented Wickramsinghe.

Conversely, domestic consumer loans continued to for the sixth consecutive month, falling by 1.2% YoY, dragged down by a 1.4% YoY contraction in mortgages.

Consumer lending drove overseas loans upwards to a 6.2% YoY growth, although this was lower than the growth in September.

“We attribute the latter partly to private-banking activities. Overall positive momentum should provide some compensation for weaker margins from falling interest rates,” said Wickramsinghe.

Nevertheless, loans for manufacturing, construction, and business services grew by 11% YoY, 9% YoY, and 33% YoY, respectively. Wickramsinghe noted that this signifies continued capacity relocation from China to ASEAN, which should drive ACU-loan demand in the medium term, given the slow burn of large capital-intensive projects.

Overseas mortgages climbed increased 6.2% YoY in October, their best clip since February 2018, likely driven by private banking as clients diversified their property holdings from markets such as the US, Europe and Australia.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise