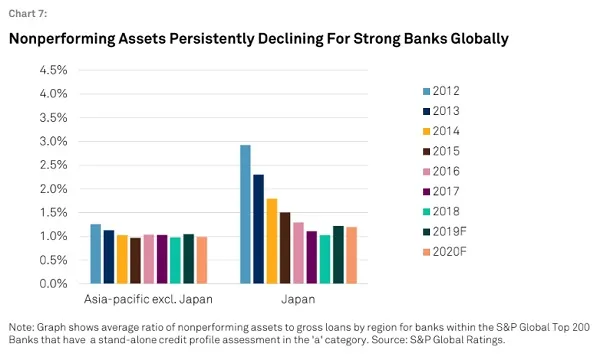

Chart of the Week: APAC non-performing assets to decline further in 2020

This will provide a buffer to declining asset quality of banks in the region.

Non-performing assets of top banks in Asia Pacific are projected to a 1% ratio in 2020, which will help support banks’ asset quality, according to S&P Global Ratings.

This excludes Japan, although the profitability-hit banking sector of the Asian country is also projected to post lower non-performing assets next year.

In particular, the “lower-for-longer” interest rates is expected to cushion banks’ asset quality metrics in 2020—a year in which certain regions and sectors are expected to face tougher times amidst the outlook of weaker corporate earnings and an environment of contracting GDPs.

Debt has been growing faster than banks’ earnings globally. It expanded 9% in H1 2019 whilst earnings before interest, tax, depreciation and amortization (EBITDA) slowed to just 1% over the same period.

Ameliorating these risks, to an extent, is the buildup of capital and reserves by banks over recent years, the diversified lending books of most large, strong banks; and the high participation by nonbanks in the leveraged debt market, noted S&P Global Ratings.

APAC loan growth is projected to slow to 7.5% in 2020, down from the 9% expansion expected in 2019 and the 9.3% growth reported in 2018, although this would still be “relatively stable” according to S&P.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise