Which credit card enjoys the highest customer satisfaction rate in Singapore?

AMEX pulled ahead of DBS and PSOB.

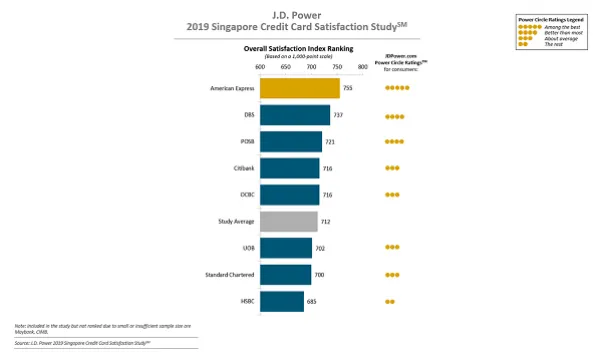

Amongst the card issuers that Singapore customers are currently subscribed to, American Express (AMEX) recorded the highest satisfaction rate with an overall score of 755, followed by DBS Bank’s with 737 and PSOB ranking third with a score of 721, according to a report by J.D. Power Singapore.

Satisfaction rates with credit card providers have steadily dropped, dipping by 6 points to 712 in 2019 due to lofty transaction fees and forex rates incurred for overseas transactions. Fears relating to the possibility of fraud also emerged to undermine credit card payments, with cash accounting for 50% of total spend abroad.

Of the two average trips taken by Singapore residents in a year, residents shell out approximately $4,800 annually. Cash is still king, however, as cardholders showed to still prefer cash over card transactions.

As other payments options are launching in the market, the preference of cash to card signals a missed opportunity for issuers to capture overseas spending, notes Anthony Chiam, Regional Practice Leader for Asia at J.D Power.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise