Malaysian banks' bad loans hit 1.61% in August

On an absolute basis, gross impaired loans rose to $80m.

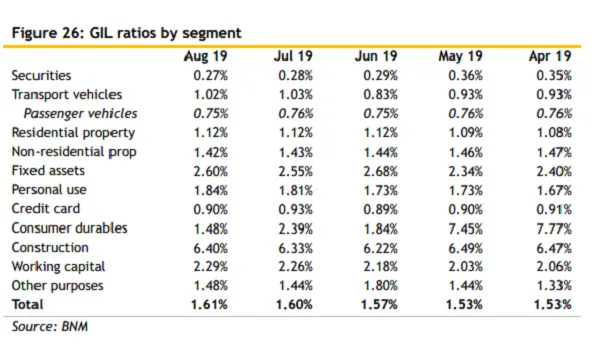

The gross impaired loan (GIL) ratio of banks in Malaysia rose slightly to 1.61% in August from 1.60% in July amidst a deterioration in the quality of loans to the manufacturing segment, according to Maybank Kim Eng.

Also read: Tepid loan growth hits Malaysian banks

On an absolute basis, GILs rose to $80.29m (MYR337m) MoM in August following an $72.42m (MYR304m) increase in manufacturing GILs.

Per segment, the GIL ratios of fixed assets, personal loans, construction, working capital and other purposes rose which offset the decline in securities, transport vehicles, non-residential, credit card and consumer durables. The GIL ratio of the residential segment held steady at 1.12%.

The slight uptick in bad loans further weighed on the sector’s growth outlook which is already grappling with muted loan growth. Loans grew by just 3.9% in August amidst shrinking consumer loan applications.

The banking sector’s capital positions trended slightly lower with core capital ratio and risk-weighted capital ratio dropping to 13.7%, 14.4% and 17.7%, respectively, from July’s 13.9%, 14.6% and 17.9%.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise