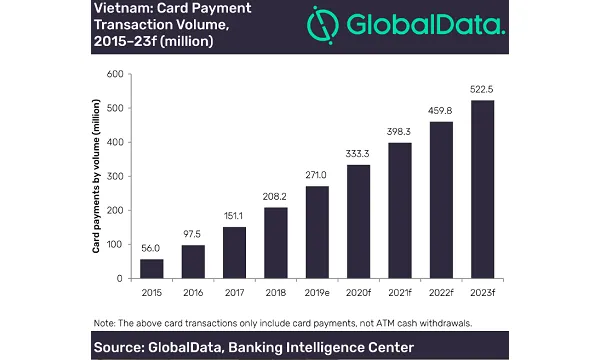

Card payments in Vietnam to hit over 522 million in 2023

The number of card payments have already rose more than fivefold in 2015-2019.

Card payments in Vietnam are expected to grow at a compound annual growth rate (CAGR) of 17.8% to 522.5 million in 2023, according to data and analytics company GlobalData.

The number of card payments already increased more than fivefold in the last five years, surging from 56 million in 2015 to 271 million in 2019 at a robust CAGR of 48.3%.

“Whilst Vietnam remains a cash-based society, the government’s financial inclusion initiatives, the emergence of digital-only banks, improved payment infrastructure and the adoption of new payment card technologies have led to the growth of card-based payments," Kartik Challa, Payments Analyst at GlobalData said in a statement.

Also read: Vietnam tops global mobile payments growth in 2019

The Vietnamese government is aiming to bring 70% of the adult population under the formal banking system by 2020 through a slew of initaitives aimed at boosting non-cash transactions like expanding bank infrastructure and licensing 30 non-bank companies to offer payment services in rural areas. Agribank, for instance, runs a fleet of over 60 mobile banking vans across the country to service remote areas.

Digital-only banks have also made inroads into Vietnam, tapping into the tech-savvy millennial customer base. Digital-only bank Timo was launched in Vietnam in 2016 whilst VPBank’s YOLO followed in September 2018.

“The government’s increasing focus on achieving a ‘less-cash’ economy, the emergence of new payment card technologies such as EMV and contactless, the advent of digital-only banks, and a strong e-commerce market will support the growth of electronic payments during the forecast," said Challa.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise