Singapore banks stomach larger asset quality risk in overseas pivot

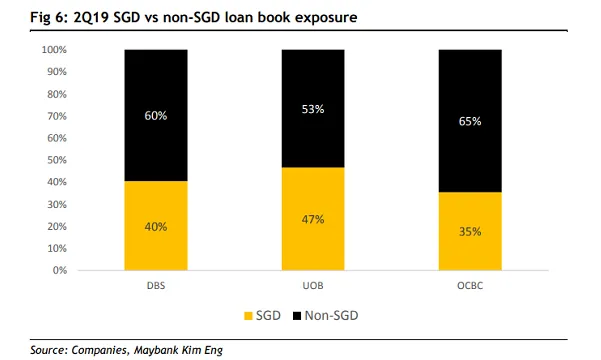

OCBC's non-SGD loan book exposure hit 65% in Q2.

Banks in Singapore are aggressively growing their overseas loan portfolios but could be taking in more risk in the process, according to Maybank Kim Eng.

Also read: Bad loans haunt Singapore banks as asset quality risks mount

Overseas lending has outpaced domestic loan exposure for all three banks. In Q2, the non-SGD loan book exposure, which includes loans booked by their oveseas subsidiaries, stood at around 65% for OCBC. The non-SGD loan book exposure of UOB and DBS hit 53% and 60% respectively.

Also read: Which bank has the highest unsecured NPA?

The result of this aggressive overseas pivot may heighten asset quality risk especially against a weakening busines environment that weighs on the ability of borrowers to pay back their debt.

"Combining aggressive overseas loan exposure in the past three years and the results of our machine learning analysis, we believe Singapore banks’ overseas exposure will be the main source of their NPL growth going forward," analyst Thilan Wickramasinghe said in a report.

The banking sector's bad loan ratio is projected to rise slightly to 1.7% by 2020 from 1.5% in 2018 as delinquencies amongst SMEs and non-financial firms rise, Moody's said in an earlier report.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise