Which Singapore bank has the highest unsecured NPA?

This lender has more than half of its bad assets unsecured.

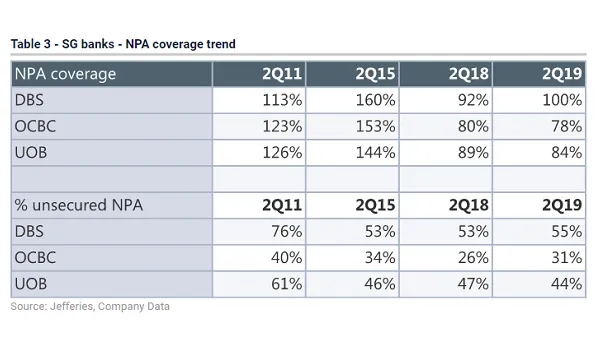

Banks in Singapore have maintained sufficient coverage for their non-performing assets (NPA) in Q2 which comes at a time when trade tensions and slowing growth weigh on the ability to repay debt, according to Jefferies.

Also read: Bad loans haunt banks in Singapore as asset quality risks mount

In Q2, DBS has the highest NPA coverage of 100%, up from 92% Q2 2018. In comparison, UOB and OCBC have respective NPA coverage of 84% and 78% over the same period.

Although OCBC has the lowest coverage of its peers, it only has 31% unsecured NPA compared to 55% for DBS and 44% for UOB in Q2.

This does not mean that DBS is trailing behind its rivals. Despite having the largest unsecured NPAs of the three, only DBS saw its NPA coverage ratio improve in the past year. In comparison, the figure has come down for UOB from 89% in 2Q18 to 84% 2Q19. Similarly, OCBC's NPA coverage fell from 80% to 78% over the same period.

In a separate report, Moody's estimates that the banking sector's bad loan ratio is tipped to hit 1.7% by 2020 from 1.5% in 2018 amidst a slight uptick in delinquencies amongst SMEs and non-financial firms.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise