Banks in Singapore brace for mounting asset risks

New NPL formation rose for all three banks in Q2 due to large overseas exposures.

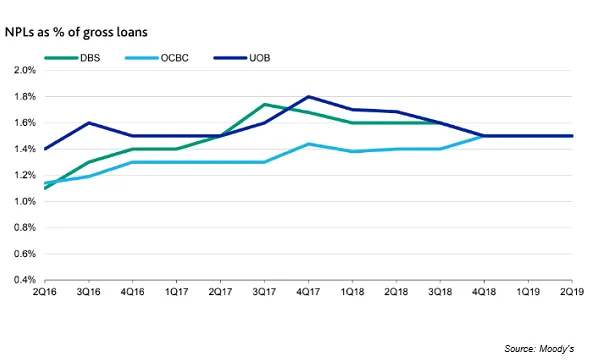

Although the non-performing loan (NPL) ratio of all three banks held steady at 1.5% in the first six months of 2019, banks in Singapore should brace in anticipation of mounting risks that will weigh in on asset quality and push credit costs up, according to Moody’s Investors Service.

New NPL formation picked up at a faster pace for all three banks in Q2 largely due to large overseas exposures, pushing up overseas NPL ratios slightly for DBS and UOB at around 1.0% and 1.5% respectively.

The formation of new stressed assets hit S$286m and S$357m respectively for DBS and UOB in Q2, data from CGS-CIMB show. Similarly, figures for OCBC rose to S$390m in 9M18.

Also read: Singapore banks' bad loan ratio to hit 1.7% in 2020

“Formation of new NPLs amongst small and medium-sized enterprises (SMEs), particularly those in trade, construction and services sectors, will accelerate because they have less financial flexibility than large corporates,” Moody’s said in the report. As of June, SME exposures accounted for about 10% of the banking sector’s total loans.

SMEs are not the only pockets of asset quality distress as large companies with significant trade exposure to China will also face risk of business disruption.” In addition, any spillover to commodity and financial markets will add to risks to corporate loan quality,” Moody’s added.

In terms of oil & gas exposures, banks have already provisioned for most stressed assets with the sector representing less than 6% of total loan commitments for all three banks. However, risks still remain especially with low vessel utilisation and charter rates, further aggravated by suppressed excess capacity in the industry.

“Credit costs will increase in the coming quarters in line with increasing asset risks,” warned Moody’s, after a stable period where credit costs as a percentage of average loans remained loan in the first six months of the year, aided by significant recoveries and write-offs from old NPLs.

In particular, CGS-CIMB raises credit cost assumptions to 22bp for FY19 for OCBC amidst further provisioning risks and UOB faces a more conservative credit cost estimate of 19bp credit cost in FY19.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise