Millennials are snapping up Asia's short-term online loans

They are the top borrowers in India, Indonesia, Vietnam and the Philippines.

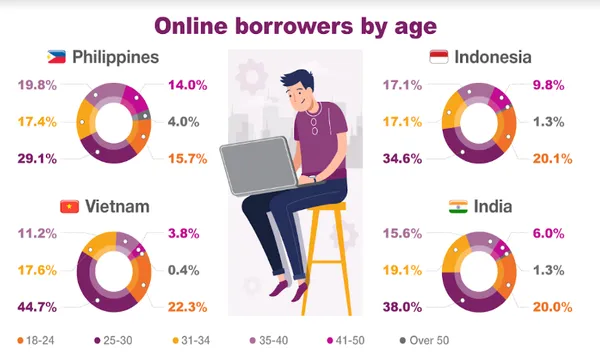

Over two in five (44.7%) of short-term loans in Vietnam were issued to Gen Y or millennials aged 25 to 30 years old, making the age group the top borrower for short-term loans in the country, according to a research by financial holding firm Robocash Group.

The age group is also the top borrower for short-term loans in India (38%), Indonesia (34.6%), and the Philippines (29.1%). Meanwhile, the study noted that Gen Z or those aged 18-24 years old made up the second largest age group of borrowers in countries such as Vietnam, Indonesia and India.

Also read: Here's where alternative lending thrives in Asia

“The younger age of borrowers in Vietnam, for example, can be explained by the rapidly growing confidence of the young people in the level of financial well-being. In the Philippines, the reason for the older age of borrowers probably lies in the high level of digitalisation of the population, which involves all age categories,” the study noted.

In a previous study, Robocash noted that In only 48.9% of Indonesians had a bank account in 2017, but 54.8% borrowed money, thereby making it a target market for alternative lending platforms.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise