Chart of the Week: Here's where Japanese banks' shrinking loan balances are hitting harder

More than half of lenders based in Chugoku, Koshinetsu, Shikoku and Tohoku earned less revenue.

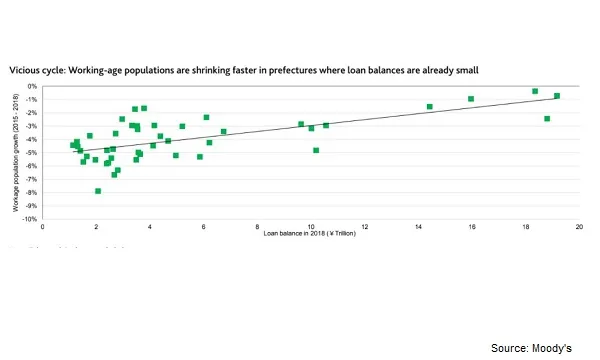

The rapidly ageing population in Japan will deal a heavier blow to banks in the regions whose working-age populations are contracting faster and are already grappling with shrinking loan balances, according to a report from Moody's. Banks in regions with the smallest working-age populations as percentages of total populations have below-average LTD ratios.

Moreover, around 60% of regional banks that earned less revenue from loans and fees than operating expenses in fiscal 2017 are based in the Chugoku, Koshinetsu, Shikoku and Tohoku regions, where populations are ageing most rapidly (in the 31-33% range) unlike Tokyo and Kanto whose elderly population are in the 23-27% range.

Japan's population started decliing in 2008 and the government is predicting a further decline of 16% from 2017 to 2045 and with the share of people aged over 65 to grow from 28% to 37% of the population.

“Pressure on profitability is particularly severe for small banks that have limited options to mitigate declines in net interest income, their main revenue source,” the ratings agency said, noting that this will lead to a decrease in credit and many corporates to accumulate cash holdings, which creates excess liquidity in the system.

“Regional banks are largely funded with deposits, and reflecting the lack of lending opportunities, their loan-to-deposit (LTD) ratios are below 80%,” Moody’s said. Data showed that banks in regions with the smallest working-age populations as percentages of total populations have below-average LTD ratios. Also, about 60% of regional banks that earned less revenue from loans and fees than operating expenses in fiscal 2017 are based in the Chugoku, Koshinetsu, Shikoku and Tohoku regions, where populations are ageing most rapidly.

These issues will not be as much a struggle for large institutions equipped with resources to invest in new businesses and can diversify their revenue sources away from domestic interest income, the ratings agency said.

Moody’s also noted that growing non-interest income is not a feasible option for small banks because they lack either resources to invest in product development or the capability to offer complex products, and in any event, demand for such products amongst their clients is minimal.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise