Chart of the Week: Global ATM numbers drop for first time as China, India and Japan shun cash

The growing popularity of mobile payments is partially to blame.

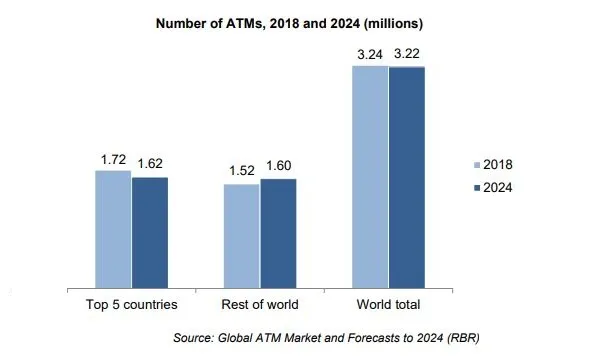

The number of ATMs in the world dropped for the first time by 1% to 3.24 million in 2018 as demand for cash dwindles particularly in five markets which have more than half of the world's ATMs, three of which are in Asia, according to a report from RBR. Machine numbers are set to drop further to 3.22 million by 2024 driven by declines in China, USA, Japan, Brazil and India.

The number of ATMs in India have shrank in the past two years despite an increase in transactions. India already has 22 ATMs per 100,000 people which represents the fewest amongst BRICS nations, according to data from the International Monetary Fund cited by Bloomberg.

Also read: Indian ATMs and bank branches are falling short of hot demand

In China, the shift towards non-cash payments have contributed to the rapid fall of ATM installations in the country.

In Japan, the ongoing branch rationalisation undertaken by megabanks to cut costs against a shrinking userbase and declining lending margins saw the ATM market shrink for the first time since 2009 as banks lean towards ATM sharing in an effort to boost efficiency and prop up struggling bottomlines.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise