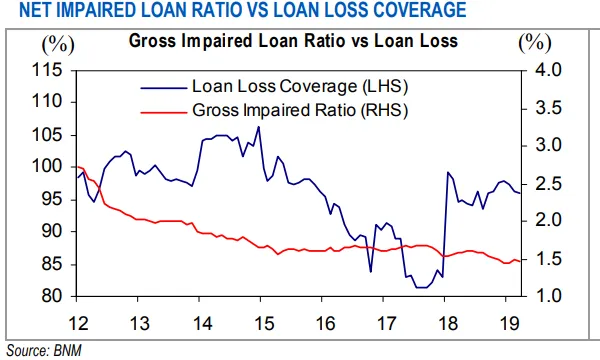

Chart of the Week: Malaysian banks' bad loan ratio down to 1.46% in March

Non-residential property loans were the only segment with deteriorating asset quality.

Malaysian banks won’t have to deal much with bad loans as gross impaired loan (GIL) ratio dipped to 1.46% in March from 1.48% in January, according to data from Bank Negara Malaysia as cited in a report by UOB Kay Hian (UOBKH).

Amongst the sectors, only loans from the non-residential property segment continued to face asset quality pressure with GIL ratio rising to 13.4% YoY.

Also read: Malaysian banks hit by lower loan demand

The report also noted that loan approval also saw a positive growth of 6.7% YoY in March, bolstered by higher working capital and automobile loan approval growth. However, loan applications continued to contract to -6.6% YoY.

“This suggests that slowing business activities and generally weaker sentiment have impacted loan activities rather than a significant tightening in banks’ credit scoring processes which have remained stable. We note that business loan application has been contracting YoY for six consecutive months,” UOBKH analyst Keith Wee Teck Keong said in a report.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise