Chart of the Week: AI business value for APAC banks to hit $98b by 2030

China, Japan, South Korea and Singapore will drive demand over the next 10 years.

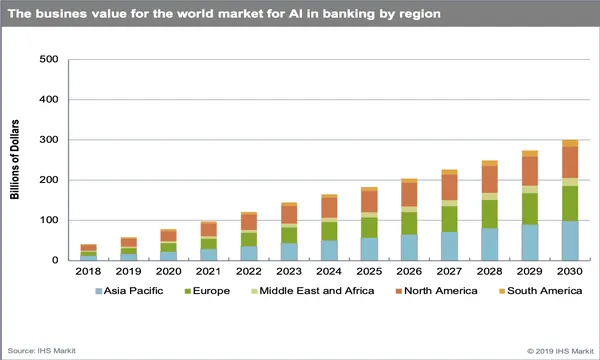

Asia Pacific is the world’s second largest region tapping on AI technology to improve and streamline operations as its business value hit $11.5b in 2018, according to analytics firm IHS Markit.

This figure is set to rise to $50.6b by 2024 and $98.6b by 2030 in line with the declining proportional importance of North America. Although North America currently ranks ahead of APAC with a market value of $14.7b in 2018, this figure will fall flat of APAC's dominance by 2030 at nearly $79b.

“Countries like China, Japan, South Korea, Hong Kong and Singapore are likely to drive the demand for AI within the banking sector over the next ten years,” Don Tait, principal analyst at IHS Markit said in a statement.

The introduction of AI technology entails heavy job losses and re-assignments as the technology increases enterprises producitivy. By 2030, around 500,000 bank workers in the United Kingdom and 1.3 million in the United States could be affected.

“Banking employees potentially impacted by the introduction of AI includes tellers, customer service reps, loan interviewers and clerks, financial managers, compliance officers and loan officers,” Tait said. “All in all, AI technology will reconfigure the financial industry’s structure, making the banking sector more humane and intelligent.”

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise