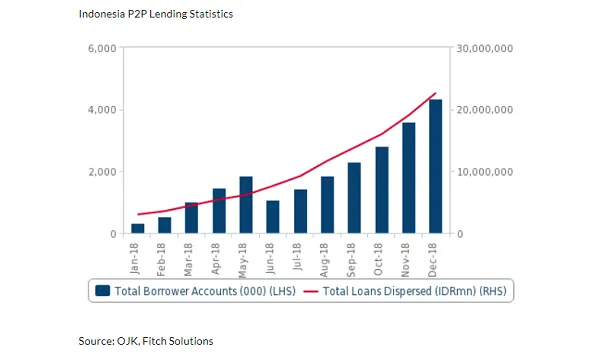

Chart of the Week: P2P lending on the rise in Indonesia amidst lax rules

P2P financiers dispersed $1,400 in loans in December.

P2P lenders have found a supportive environment in Indonesia as relatively lax regulations have enabled the industry to thrive and disperse a total of $1,400 (IDR20m) loans in December 2018, according to Fitch Solutions.

Official statistics show that there are 64 operational P2P lenders as of June 2018 although reports suggest that there as many 99 legal entities registered with the central bank. The number is likely to rise given strong demand from low and middle-income borrowers who were attracted by the scheme's low borrowing costs and less stringent requirements than traditional banking arrangements.

"We believe that the e-money and peer-to-peer (P2P) lending segments possess the strongest growth potential within the fintech space," Fitch Solutions said in a report.

Also read: E-money transactions in Indonesia hit $3.3b in 2018

Fintech companies have been actively driving inroads into Indonesia as the country's banks have only recently started to realise the growth potential of digitising their services to expand financial inclusion.

As of 2017, the percentage of adults with a bank account rose to 49% from 20% in 2011, data from the World Bank show.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise