E-money transactions in Indonesia hit $3.3b in 2018

Users turned to digital money for e-commerce, mobile SIM top-ups, and public transport.

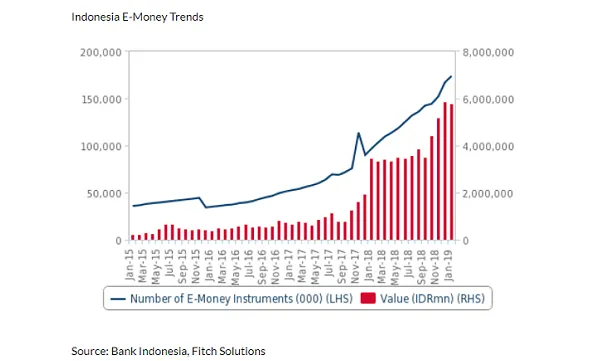

E-money transactions in Indonesia hit $3.3b (IDR47.2t) in 2018 as fintech firms took advantage of gaps in the financial infrastructure and low financial inclusion to grow their consumer base, according to Fitch Solutions.

Also read: 7 in 10 Indonesian banks threated by ride-hailing firm Go-Jek

As many as 173.8 million digital money instruments have been issued by January 2019, a service which largely leverage on mobile phone numbers for identification. Users embraced digital money instruments for a wide range of consumer needs including e-commerce, mobile SIM top-ups, parking fees and public transport ticketing.

"The e-money and payments segment continues to show strong growth, and consolidation within the sector is positive to improve services and ease competitive pressures," Fitch Solutions said in a report.

Although the country is home to 36 licensed electric money issuers, Indonesia's electronic money landscape is primarily led by two independent players - Go-Pay and OVO - and one operator-led service called G-Cash as banks lag behind third-party players and have only started responding to the digital threat with the planned rollout of a mobile wallet service called LinkAja.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise