Chinese banks' record-high lending boost only short-term gains

Short-term loans surged 57.8% in January whilst mid- and long-term loans only rose 5.3%.

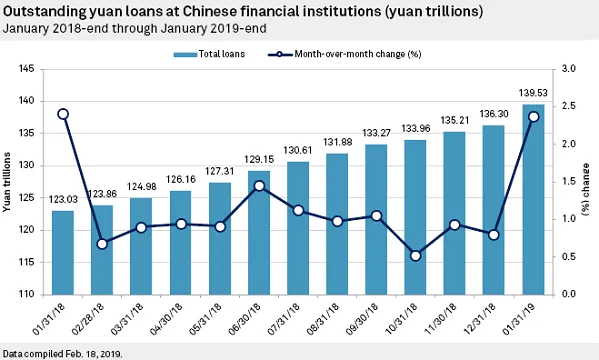

The new loans extended by Chinese banks which hit a record-high $480.75b (CNY3.23t) in January may belie a different story than the glowing headline figures suggest.

Also read: Chinese banks loan growth to hit 13.8% in 2019

Although the strong lending momentum may be a cause for celebration as the economy has started growing after expanding at the slowest pace since 1990 at 6.6% in 2018, the gains can only be felt when lending affects the real economy, Deng Lijun, chief macroeconomic strategy analyst at Chuancai Securities said in an S&P report.

In a breakdown, short-term loans surged 57.8% YoY in January even as new mid- and long-term loans only inched up 5.3% over the same period, data from S&P Global Market Intelligence show.

“In recent weeks, however, the growing demand for short-term loans could be a sign that many borrowers are looking for quick liquidity amidst deeper, nonseasonal cash-flow challenges rather than for investments that will underpin sustainable growth,” added Lijun.

The government has been actively encouraging banks to lend more to credit-starved businesses as policymakers have facilitated five cuts to reserve requirements since the beginning of 2018. The cost of lending has also fallen with the key one-year Shanghai interbank lending rate standing at 3.059% as of March 1, down from 3.52% at end-2018 and 4.75% at the beginning of 2018.

However, Lijun cautions that it may take more time before stronger growth in mid- and long-term loans can be felt especially with the growing tendency towards short-term gains.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise