Chart of the Week: Thai banks ramp up lending to risky SMEs

SME loans accelerated to 7.2% in September 2018 from 2.4% in 2017.

Thai banks continued to open up their loan books to the risky SME sector in 2018 as loans picked up pace to 7.2% in September 2018 from 2.4% in September 2017, according to Fitch Solutions.

Also read: Thai banks bear the brunt of lower SME lending rates

SMEs, which account for a little over a third (33.6%) of Thailand banks' overall loans, failed to benefit from the upswing in exports as they still grapple with deteriorating asset quality.

"[L]oans to consumer and small and medium-sized enterprises (SMEs) have both been the fastest expanding categories since at least the end of 2017, and we therefore believe that they pose the largest risks to the Thai banking sector," the research firm said in a report.

Also read: Is the worst over for Thai banks?

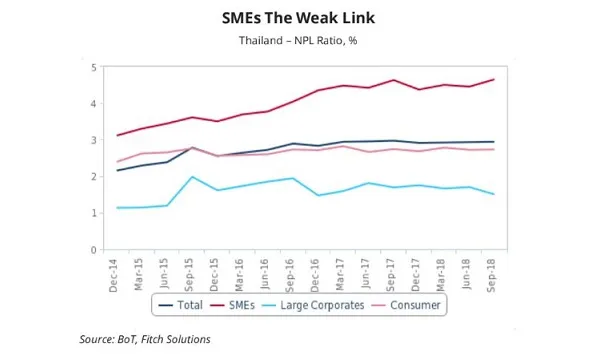

As of Q3 2018, the sector's non-performing loan (NPL) ratio rose to 4.7% from 4.6% the previous quarter in 2017. With the inclusion of speecial mention loans, the NPL ratio jumps to 7.3% in Q3 2018.

"The difficulties faced by SMEs were in stark contrast to that of large corporates, with their NPL ratio comiong in at a low and healthy level of 1.5% in Q318, marking an improvement from 1.7% in the same period a year ago," added Fitch Solutions.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise