MasterCard campaigns for contactless payments in the Philippines

The card’s debit purchase volume in the Philippines up 47% as it posed a 46% rise in e-commerce transactions in the Southeast and South Asia markets.

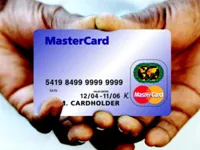

Filipinos will continue to have utmost confidence in cash, but it does not mean that “contactless payments” will not be able to gain headway, MasterCard said on Monday.

Matthew Driver, MasterCard division president for Southeast Asia. --Jonathan L. Cellona said: “In the Philippines, cash still plays a vital role in every Filipino’s transaction. About 90% of the transactions done in the country are still settled through cash as people feel more secure with this mode,” said Matthew Driver, MasterCard Worldwide division president for Southeast Asia, told reporters on Monday.

Mr. Driver was in Manila as part of a regional tour.

However, given the advances in technology, contactless payment, where there is no physical contact between a consumer’s payment device and a physical point-of-sale terminal -- a cardholder will just tap his MasterCard card on a point-of-sale terminal to pay for purchases -- should “become more popular over time,” Mr. Driver said.

Poch L. Villa-Real, MasterCard country manager, clarified that contactless payment is yet to be introduced to the Philippines but notes its potential given the significant increase in “cashless transactions in the country last year.”

MasterCard, specifically, recorded a 47% growth in its debit purchase volume in the Philippines. It also notched a 46% rise in its e-commerce transactions in the Southeast and South Asia markets, which include the Philippines.

View the full story in Business World.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise