Malaysia moves to enable money transfer via mobile number

Users can transfer money through DuitNow by December.

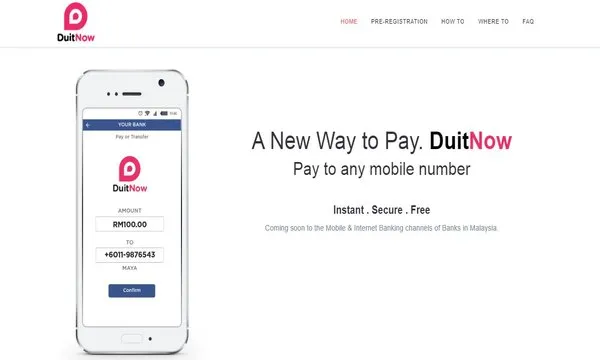

Malaysia is taking a leaf out of Singapore’s playbook as it moves to enable fund transfer via mobile number as banks across the country and national financial market infrastructure provider Paynet prepare to launch electronic fund transfer service DuitNow on December, according to a press release.

Instead of providing their bank account numbers, users need only share their mobile phone number with DuitNow although they could choose other identifiers like MyKad or MyPR identity card numbers, Army or Police numbers, passport numbers or business registration numbers with which they can link their bank accounts.

Also read: Malaysia takes step forward to realise open banking ambitions

Whilst a one-time registration is needed to receive payments, customers do not need to register to use DuitNow to make payments as customers can access DuitNow in the online and mobile banking channels of their respective banks.

“DuitNow allows bank customers to receive payments without the hassle of having to divulge their bank account number,” said Peter Schiesser, Group CEO of PayNet. “In the future, government agencies and businesses may disburse payments using MyKad numbers.”

Seven banks have already reached out to their customers for pre-registration. Payments of up to RM5,000 is free for consumers and SMEs.

“The launch of DuitNow will deliver a quantum leap in e-Payments value proposition to make it fast, frictionless and convenient to meet the demands for immediacy in an increasingly digital and connected world” added Schiesser.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise