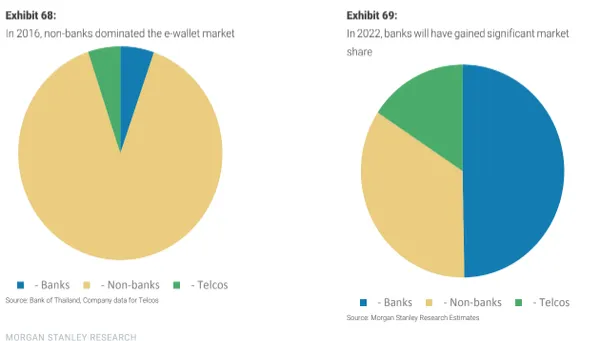

Chart of the Week: Thai banks put up fight against telcos in e-wallet war

Lenders will snap up half of the market in the next four years.

Thai banks are not letting up without a fight against telcos and independent players in the country's heating e-wallet war as they are poised to grow their market share from a little over 6.25% in 2016 to dominate half of the market by 2022, according to Morgan Stanley.

Also read: Thailand's digital banking shift to boost revenue

Their bid is supported especially since the country's regulatory regime favors incumbent lenders over new players into the scene which also holds true for Malaysia and Singapore but unlike the Philippines where telcos are putting traditional lenders out of the running.

Morgan Stanley estimates the e-wallet opportunity in Thailand at $42m to $64m which could grow to $248m to $363m by 2024 as rising rates of smartphone penetration will boost adoption of e-payment technologies.

"We assume there are 2.7m telco e-wallet users today, which represents ~4% of total smartphone subscribers in Thailand. By 2022 this grows to 10.9m or ~16% of total smartphone users," the firm added.

There are also around 26 e-wallet transactions per annum which is poised to grow to 105 by 2023. However, the price per transaction is forecasted to fall from $0.31 (BT10) in 2017 to $0.015 (BT0.5) by 2022.

Proactive tech investments by the country's top lenders, especially Kasikornbank, means that cost income ratios will remain stable as banks start reaping the rewards of effiiency gains. In fact, Kasikornbank reported that the number of its users on its mobile banking channels hit 7.3 million users by the end of 2017, which represents a tenfold increase from 2014.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise