Chart of the Week: Telcos are devouring the Philippine e-payments market

Banks are losing market share as a result.

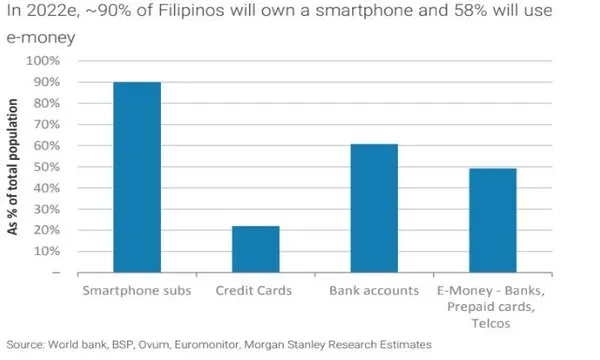

High levels of smartphone usage and a large unbanked population represents a massive opportunity for greater e-wallet adoption in the Philippines as Morgan Stanley joins the chorus of analysts expecting take-up of the payment technology to double from a little over 20% in 2016 to 58% by 2022.

"We assume there are 0.8m telco e-wallet users today, which represents ~1% of total smartphone subscribers in Philippines. By 2022, this grows to 11.6m or ~11% of total smartphone users," the firm said in a report.

Also read: Smartphone banking booms in Asia as digital penetration expands threefold

The e-wallet opportunity in the Philippines is around $192m to $280m which could easily grow to as much as $1.1b by 2022. Of this market, telcos are fast putting banks out of the running as leading telecommunications provider Globe is poised to be the dominant player due to its joint venture with Alipay. PLDT comes in at close second.

Glaring gaps in the existing financial infrastructure and slow regulatory response has allowed non-bank players like telcos to take advantage of a underserved market, noted Morgan Stanley. Banks in the country also charge for simple transactions which could push customers to look for cost-friendlier alternatives.

In fact, telcos may even encroach into the territory of banks and go into lending amidst the wealth of customer data they hold which they could either sell to banks for loans and insurance products or go into the business themselves.

"The Philippines is the only market where we see an opportunity for the telcos to actually offer leading product themselves rather than just receiving a referral payment. We assume by 2022 3% of telco e-wallet customers will take a loan originated throught the e-wallet," forecasted Morgan Stanley.

This corresponds with the findings of an earlier report by consultancy firm Oliver Wyman who expects e-wallets to continue amassing market share in the Philippines over the coming years after the value of non-cash transactions rose from 18% in 2012 to 24% in 2016. “The Philippines is on the cusp of a digital payments revolution, and non-cash payment methods – particularly e-wallets – are expected to surge to six percent of payments by 2022."

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise