Chart of the Week: Malaysian banks bad loans down to 1.59% in June

Banks shed bad loans in construction and working capital.

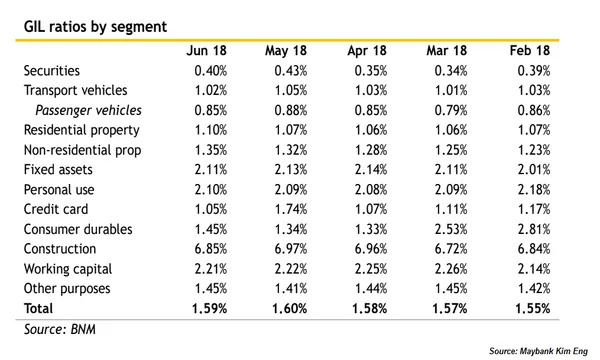

The gross impaired loans (GIL) of Malaysian banks dipped from 1.60% in May to 1.59% in June amidst a broad-based improvement in the asset quality of most lending segments, according to Maybank Kim Eng.

Also read: Here's why the abolition of good and services tax is positive for Malaysian banks

"The overall ratio was stable with a slight uptick MoM in the GIL ratios for personal loans as well as residential and non-residential property loans. This was offset by a lower MoM GIL ratio for auto and credit cards," Maybank Kim Eng analyst Desmond Ch'ng said in a statement.

Also read: Will the HSR cancellation dampen Malaysian banks' loan growth?

This was led by ongoing improvements in credt card segment whose GIL ratio fell from 1.74% in May to 1.05% June. The bad loan ratio of construction loans also dipped from 6.97% to 6.85% over the same period.

Improvements were also seen in the asset quality of securities, transport vehicles, and fixed assets.

On the other hand, GIL ratios of residential proeprty inched up from 1.07% in May to 1.10% in June. The stressed loan ratios of non residential property and consumer durables also rose to 1.35% and 1.45% respectively.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise