Chart of the Week: Here's how China's shadow banking crackdown hit assets in 2017

Financial investments and interbank activities were the most battered areas.

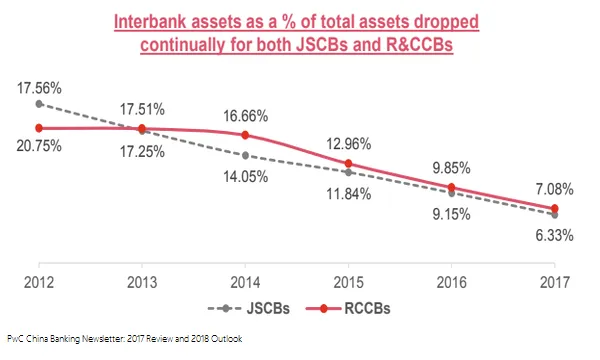

Chinese interbank assets as a share of total assets plunged for both joint-stock commercial banks (JSCBs) and rural and city commercial banks (RCCBs), according to a report from accounting firm PwC, as Beijing intensifies its shadow banking crackdown to curb off-balance-sheet activity.

The interbank assets of JSCBs plunged from 17.56% in 2012 to a mere 6.33% in 2017, whilst RCCB assets dropped from 20.75% in 2012 to 7.08% in 2017.

“The China Banking Regulatory Commission launched a crackdown on irregularities and misconduct at the start of 2017, focussing on interbank lending and wealth management products in particular,” said Jimmy Leung, PwC China financial services leader.

Also read: New regulations to overhaul China's outdated wealth management model

“Regulators required banks to ensure a stable source of liabilities. So we saw a reduction in listed banks’ interbank assets, which we expect to continue as we move through 2018.”

The growth of financial investments also slowed down for JSCBs from 35.27% in 2016 to 32.95% in 2017 whilst it inched up marginally for RCCBs from 44.53% in 2016 to 44.61% in 2017.

“Looking ahead into 2018, we can see that the measures taken to reduce risk are also reducing the problem of idle funds in banks,” added Leung. “At the same time, new regulations will push up compliance costs and rising interest rates will affect the cost of capital. We envisage that certain banks will be able to benefit from the new rules on provisions, whilst others may need to boost their capacity to manage credit risk and to focus on improving profitability and capital adequacy.”

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise