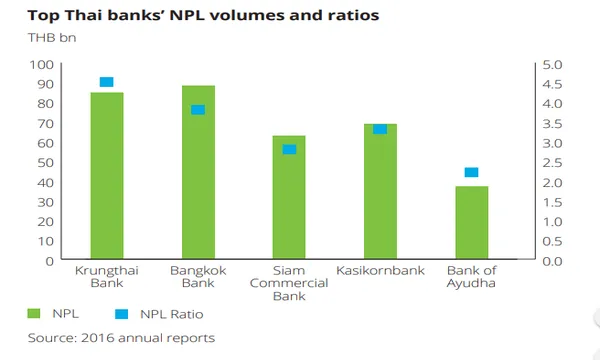

Chart of the week: Check out the bad loan ratio of Thai banks in 2017

Gross NPL volume rose 20% to $11.6b in Q2.

Whilst the banking sector in Thailand has shed a significant amount of non-performing loans (NPLs) in recent years brought about by growing regulatory pressure to meet reserve requirements, NPL volumes across major banks remain high, according to a study from Deloitte.

With the increase in NPL volumes, banking portfolios are becoming larger (>$500m GBV) and there has been a shift towards commercial and SME loans from predominantly retail assets. This comes as banks like Siam Commercial Bank, TMB Bank, and Bank of Ayudhya (Krungsri) have been selling portfolios for a number of years to local investors who are often able to cherry pick selected tranches in effect, carving up portfolios into small tranches to facilitate sales.

Here's more from Deloitte:

Distressed assets to date have been sold to the two state-owned AMCs: Bangkok Commercial Assets Management (BAM) and Sukhumvit Asset Management (SAM). In 2015 BAM bought a total of US$751m worth of NPLs from financial institutions, and at the end of 2015, the two AMCs held US$2.3bn and US$1bn of assets respectively.

Given the noticeable increase of NPL volumes in the country, large institutional investors have started to consider acquiring or establishing licensed platforms in preparation for future loan trades. More recently there have been a few small deals in the market including Apollo’s acquisition of CSG, Bain’s acquisition of Standard Chartered’s NPL business and SSG’s acquisition of a loan servicing platform from GE Capital.

Investors have to use an AMC as a vehicle to acquire NPLs. AMC investments are covered under the ‘AMC Decree.’ The AMC Decree provides legal rights over loan collateral, enforcement of claims, and the continuity of interest. In 2012 the Bank of Thailand passed legislation allowing banks to purchase NPLs from other banks and local legal entities, although there are certain limitations.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise