Indonesia’s fintech investments bucks global trend, hits record high in H1

Payment gateway Xendit raised $300m in its Series D funding to help push up the numbers.

Fintech investment in Indonesia is expected to rise in 2022, bucking global fintech investment trends that point to a significant fall in funding this year.

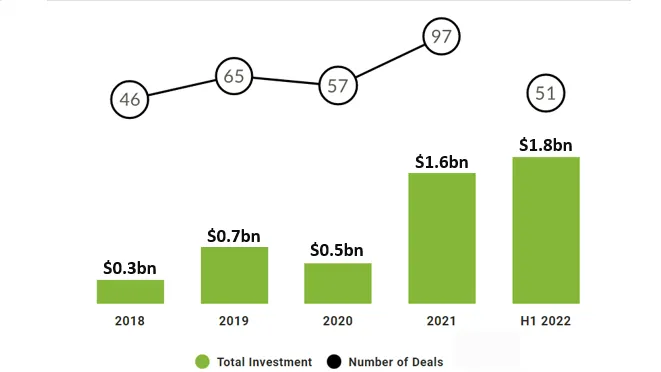

Investment value in Indonesia in just the first half of the year has already surpassed the previous year, with $1.8b reported across 51 deals in 2022. In comparison, $1.6b investments were received by Indonesian fintechs for the full year of 2021.

Payment gateway Xendit logged the largest deal in H1, raising $300m for its Series D funding, led by Coatue and Insight Partners.

For the full year, Indonesia’s fintech investments is expected to reach $3.6b, whilst deal activity in the country is expected to increase slightly by 5% reaching 102 deals in 2022.

The growth contrasts that of global fintech funding. Globally, investments dropped 24% from Q1 to Q2.

One market affected by the global trends is Australia, who saw its fintech investments plummet 75% from Q1 to Q2.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise