Bank of the Philippine Islands

Bank of the Philippine Islands is one of the largest banks in the Philippines, and is second largest in terms of market capitalization. It is considered the first bank in both the Philippines and in Southeast Asia. It was formed during the Spanish colonial era under the name El Banco Español Filipino de Isabel II.

‘Robust’ revenues lifted BPI to record net income in H1

‘Robust’ revenues lifted BPI to record net income in H1

Earnings per share is PHP5.8 for the period, a 14% increase.

BPI Private Wealth aims to double assets and capture 25% local HNW market

CEO Maria Theresa Marcial says they are targeting US$53b in AUM by 2026.

BPI, Helios roll out solar mortgage program in the Philippines

It has a 7% interest rate and has already onboarded 100 new homeowners.

Mizuho, BPI renew business cooperation agreement

The agreement aims to provide Japanese companies with banking support in the Philippines.

BPI doubles GCash e-loading fee

GCash loading via ECPay fee will be charged PHP10 starting March.

It's the most wonderful time of the year for ABF!

Asian Banking & Finance will be back on 8 January 2024.

BPI eyes shifting branch agent role from transactions to advisory: exec

President and CEO TG Limcaoco said that BPI wants their branch agents to spend 70% of their time offering advice to clients.

CEO TG Limcaoco to speak on BPI’s digital transformation at Manila forum

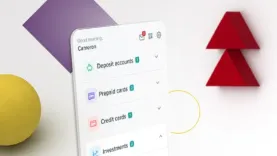

Bank of the Philippine Islands (BPI) has a big and bold ambition — that is to have 50 million customers by 2026; and it intends to do it by embracing digital innovation for banking excellence.

BPI’s first half earnings leaps one-fourth from last year’s

It reached a consolidated net earnings of P25.3b during the period.

BPI net income up 23% to $461.09m

Net interest income rose 27% but non-interest income fell.

Bank of the Philippine Islands relocates main office temporarily

This is in view of the temporary relocation and consolidation of its three leased offices.

BPI Wealth tasked by PH state insurance to manage $45m investment fund

The investment fund amount is P2.5b.

Central bank rate cuts could raise Philippine banks’ earnings by 2.6%

Every 100bp rate cut would free PHP106b of liquidity.

PH banks missing out on revenue from growing middle class market

Over 7 in 10 loans made by banks are extended to corporates– leaving 15 million SMEs and self-employed workers with little access to traditional finance.

BPI’s Q1 net profit increases by 52%, boosts efforts toward financial inclusion

The January to March performance was driven by the bank’s average asset base expansion, margin growth, and lower provisions.

Bank of the Philippine Islands’ net income reaches record $722m in 2022

Revenue was bolstered by growth in its net interest income.

Bank of the Philippine Islands' issues $373m fixed-rate bonds due 2024

BPI Rise Bonds have an interest rate of 5.75% per annum.

Advertise

Advertise