Consumer spending to drive card payments in South Korea

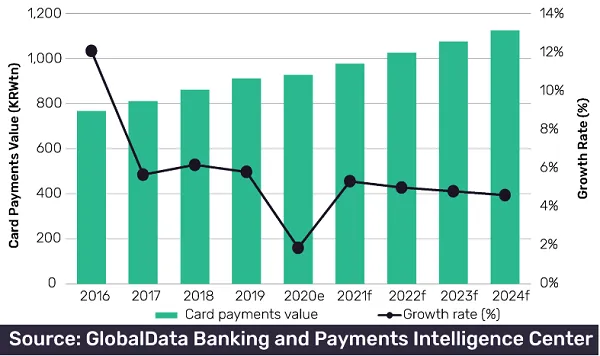

The sector is posed to grow at a CAGR of 4.3% from 2019 to 2024.

A surge in consumer spending amidst the easing of COVID-19 restrictions will fan the further rise of card payments in South Korea, according to a GlobalData report.

Card payment transactions in the country are expected to grow at a CAGR of 4.3% from $791b (KRW913t) in 2019 to $976b (KRW1.12t) in 2024. ATM cash withdrawals will see a 3% decline over the same period.

To prop up consumer spending, the South Korean government has granted emergency payout of up to$860 (KRW1m) credited to households’ credit card accounts in the form of points, which can be used for payments to select merchants but not for personal savings.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise