Zed challenges banking norms with no interest, forward-looking credit card

The soon-to-be-launched card will underwrite based on present and future income, not just past financial records.

Zed’s journey to building a credit card with no interest, no foreign transaction fees, and no annual fees in the Philippines traces its inspiration from an unlikely constant in the country: traffic.

“Danielle [co-founder] and I were on our way to meet some friends in Makati [business district] for dinner. It should have been only a five-kilometer drive. But what should have been a 20-minute trip ended up taking over an hour. And when I started to ask folks… what was going on, that’s when I was introduced to the concept of payday Friday,” Steve Abraham, Zed co-founder, told Asian Banking & Finance in an exclusive interview.

“These people had high disposable incomes. But when bills came, there wasn’t a credit card in sight,” Abraham recalled.

He and co-founder Danielle Cojuangco-Abraham have since heard story after story of young Filipino professionals with go

od income backgrounds, who were denied credit cards from traditional banks — including Cojuangco-Abraham’s own brother, a lawyer in a big law firm.

This is because traditional banks in the country have the tendency to look across the whole historical financial file of an individual customer, which may not reflect their current financial stability and high incomes. “Even if you’re a well-educated, well-paid, well-employed young professional in the Philippines, you still are being prevented from accessing a credit card simply because of a bank file,” Abraham said.

As a result, only 8% of Filipinos own a credit card, according to data from the Bangko Sentral ng Pilipinas (BSP).

The two decided to bring together their combined banking and engineering backgrounds to found Zed and launch a credit card in the Philippines.

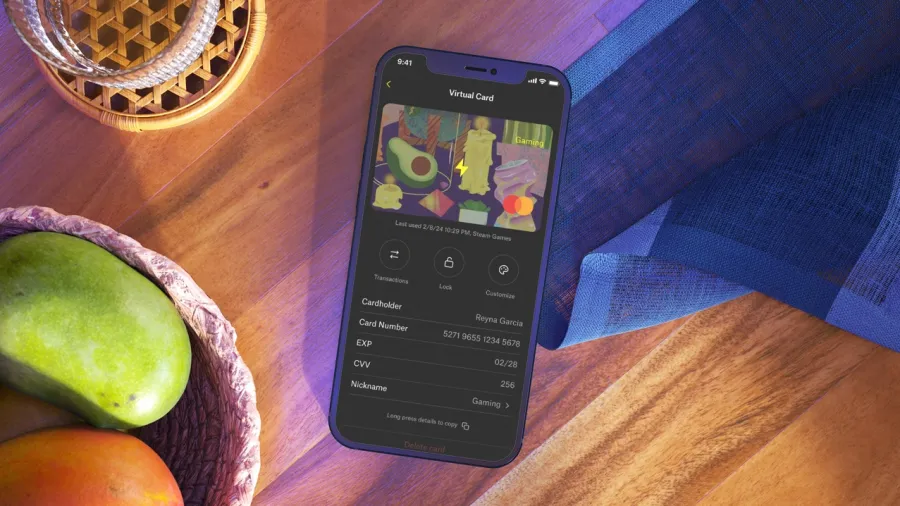

Zed’s Mastercard Titanium credit card boasts of no interest, no foreign transaction fees, no annual fees, and is tied to an app. The up-and-coming credit card app, whilst still in their pilot stages, have already raised $6m in a funding round that included Peter Thiel, the founder of PayPal.

Filipinos are also excited: despite not yet launching, Zed already has over 34,000 people joining its waitlist.

The future, not the past

Instead of just looking at their customers past financial history, Zed instead decided to look into their present and their future incomes.

“One of the things that we do is we underwrite based on current and future income, which not only opens up access to a lot of these hybrids of professionals who have high and stable incomes,” Abraham said.

This also ends up providing smarter credit limits, with the co-founders saying that their future customers’ credit profiles do not necessarily represent their past and current earning power.

Zed’s in-house-built tech stack and positioning as a fintech means that the company will not have to worry about overhead costs from physical bank branches or manual back-office processes.

“Because of that, we’re able to pass those savings back to our customers in the form of the no fees, the no revolving interest and just generally better customer service,” Abraham said.

Separate balances

Balances will also be held separate for different transactions, enabling customers to avoid bigger interest payments.

“One way we think traditional credit cards have really led people to unsustainable spending habits is by having that one single balance that includes everything from the very big purchases,” co-founder Danielle Cojuangco-Abraham noted.

For example, an individual makes a big furniture purchase alongside groceries and other small daily purchases. What ends up happening is as the balance is combined, when you end up having to roll-over your payments to the next month, you have to pay interest on both.

“I don’t think anyone considers that a success to have ended up paying interest on your grocery purchases because of just one balance on one card,” Cojuangco-Abraham said.

Going home

Zed wasn’t their first company venture: the two had earlier co-founded a fintech company called Simple in the US, where they have been living and working for the past two decades.

“As we were wrapping up the acquisition of that company in late 2019, we happened to be visiting my family here in the Philippines. And at that point, we thought, ‘What’s next?’” recalled Cojuangco-Abraham.

Prior to launching Zed and Simple, Cojuangco-Abraham worked in the Silicon Valley as a product designer, whilst Abraham worked in investment banking before returning to tech.

Although founder Cojuangco-Abraham grew up in the Philippines, the years she spent working and living in the US had made her accustomed to the conveniences of using a credit card. But she never forgot about her home country, she said.

“I believe there’s still so much opportunity to make an even bigger impact on many more people by working on something here, than I would be if I would be working on something in the US. That’s the realisation I came to at that point in my career,” she said.

“I really wanted to come home, turn my attention to this problem, and to be able to use technology to be able to help this next generation have both better access as well as a better experience around financial services,” she added.

Cojuangco-Abraham’s vision is shared by over 34,000 Filipinos who have joined the waitlist for the card even before its launch.

here are currently no plans to expand beyond credit cards — it will be Zed’s single product for the foreseeable future as they work with the Bangko Sentral ng Pilipinas (BSP) to secure a license.

“We’re working with the BSP to complete our licensing as a non-bank credit card issuer. Until that’s complete, we’re issuing a limited number of cards through a pilot programme,” she said.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise