Chart of the Week: Korean virtual banks still struggling to crack the profitability code

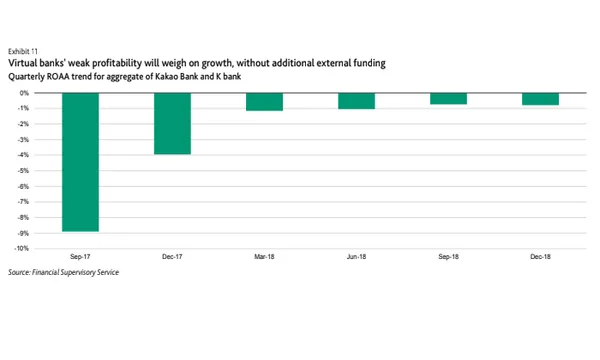

ROAA is still relatively low at -0.9% in December 2018.

This chart from Moody’s shows that Korea’s virtual banks are having trouble turning a profit as return on average assets (ROAA) stands at a relatively low at -0.9% in December 2018. The latest figure, however, marks an improvement from -7.2% in December 2017.

Also read: South Korea's web-only banks lose steam as they book massive half-year losses

“Virtual banks' profitability will be low, reflecting a strategic use of competitive pricing to gain market share in a modestly growing banking market. This strategy was exaggerated in the past 18 months with heavy promotions, as the two new banks offered lower lending rates and higher deposit rates,” Moody’s said in a report.

In 2017, K Bank and Kakao Bank posted net losses of $74m (KRW84b) and $92m (KRW104.49b), respectively, data from Korea Federation of Banks (KFB) show.

Despite the repercussions, Moody’s believe that the virtual lenders are likely to push through with their aggressive pricing strategy until a meaningful scale is reached.

“External capital access will be a key driver of virtual banks' potential growth because profit and therefore internal capital generation, will remain low in the coming years,” Moody’s continued.

Kakao Bank and K Bank have only managed to capture just 0.6% of the KRW-denominated loans market as of end 2018. Both lenders have been the most active in the unsecured personal loan market with plans to extend to retail loan segments like mortgages.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise