How Asian banks can retain their cross-border dominance

The emergence of fintechs is whittling down their dominance.

Banks are losing their market share in the cross-border payments space. Non-bank market share has risen to 12% in 2021 and will rise to 17% in 2024, according to data from McKinsey & Company. This may not seem much for now, but it illustrates how financial technology (fintech) may just overtake traditional lenders in this space.

“Disruption in the Asian cross-border payments market is most powerfully illustrated by the emergence of numerous fintechs, which are bringing together capabilities across payments and transaction banking—including FX currency, trade, and treasury services. Many have also added value through services focused on FX risk management, cloud-native technology platforms, and API integration,” McKinsey noted in its report “How Asian banks can regain the cross-border payments crown.”

In Asia, banks are expected to see the most reduction in market share in the small and medium enterprises (SME) space and the customer-to-customer (C2C) space.

On the upside, banks still retain core strengths that will be key to them maintaining their dominance for years to come, McKinsey said.

ALSO READ: Value of CBDC payments to reach $213b annually by 2030: study

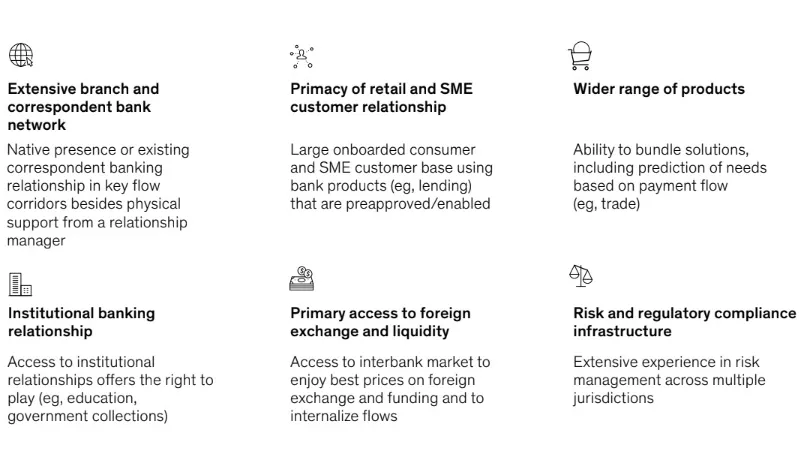

“Banks’ core strengths, including extensive branch and correspondent banking networks, support relationships and servicing in key flow corridors. And their large consumer and SME customer bases position banks to launch new services,” the report said.

Asian banks also have a cost advantage in interbank markets, as well as extensive risk and compliance infrastructures, implying a lower marginal cost of risk.

“If banks can compete with fintechs on price, user experience, and speed, there is limited incentive for customers to look elsewhere,” McKinsey said.

The possible emergence of central bank digital currencies (CBDCs) and interoperability of payment systems may also offer potential avenues for exploration as banks consider how the payments landscape will change, the consulting firm added.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise